The Role of Data Science in Fraud Detection & Risk Management

What is Fraud Detection?

The Role of Data Science in Fraud Detection and Risk Management

Key areas where Data Science is used for Fraud Detection

FAQ's

In today's interconnected and digital landscape, the threat of fraud looms over various industries, causing financial losses and eroding trust. Whether it's identity theft, payment fraud, or cybercrime, fraudulent activities can manifest in countless forms and impact organizations of all sizes.

Data science , with its arsenal of techniques like anomaly detection, machine learning, and predictive analytics, plays a pivotal role in this fight against fraud. It helps industries pinpoint anomalies, predict potential risks, and adapt to evolving tactics employed by fraudsters.

What is Fraud Detection?

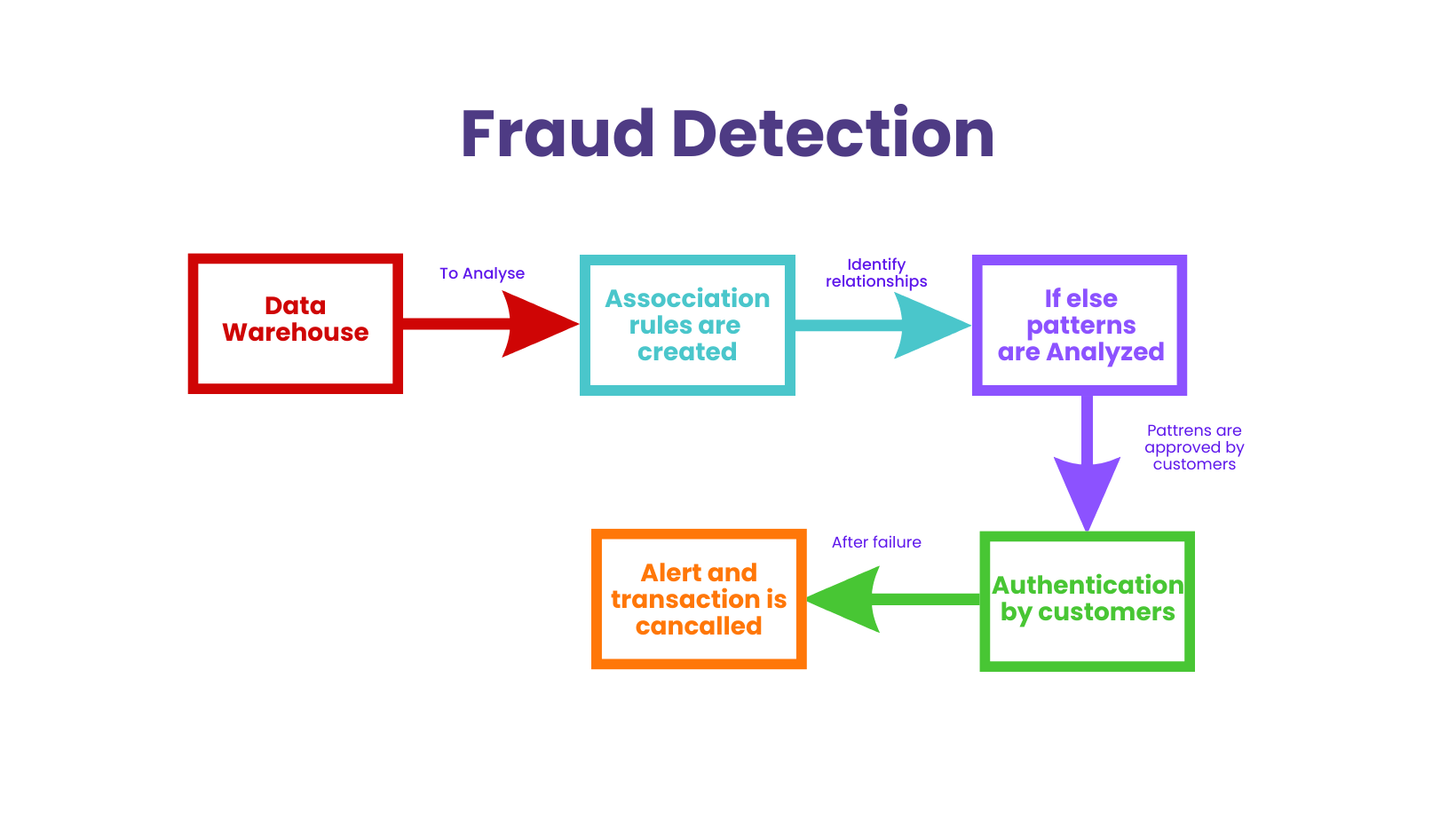

Fraud detection refers to the process of identifying and preventing fraudulent activities or behaviors within various systems, processes, transactions, or interactions. It involves the use of techniques, technologies, and methodologies to uncover instances of deception, misrepresentation, or illegal actions designed to gain unauthorized benefits or advantages. The goal of fraud detection is to minimize financial losses, protect the integrity of operations, and maintain trust within organizations and their stakeholders.

Fraud detection encompasses a range of approaches, including manual investigation, rule-based systems, and advanced technologies such as data analytics, machine learning, and artificial intelligence. These methods help identify anomalies, patterns, or deviations from normal behavior, which could indicate potential fraud. By analyzing large volumes of data, identifying unusual activities, and recognizing trends, organizations can take timely actions to mitigate risks and prevent fraudulent activities from causing harm.

Industries such as finance, insurance, e-commerce, healthcare, and telecommunications heavily rely on fraud detection systems to safeguard against a wide array of fraudulent activities, such as identity theft, payment fraud, insurance fraud, cybercrime, and more. Effective fraud detection systems combine domain knowledge, cutting-edge technologies, and continuous learning to stay ahead of evolving fraud techniques.

The Role of Data Science in Fraud Detection and Risk Management

Data Science plays a critical role in fraud detection and risk management across various industries, including finance, e-commerce, healthcare, and more. Its application helps organizations identify and prevent fraudulent activities, minimize risks, and make informed decisions. Here's how Data Science contributes to these areas:

Data Collection and Aggregation: Data Science starts with collecting and aggregating vast amounts of data from various sources, such as transaction logs, customer profiles, user behaviors, and external databases. This data might include financial transactions, login details, IP addresses, device information, and more.

Data Preprocessing: Raw data often contains noise and inconsistencies. Data preprocessing involves cleaning, transforming, and structuring the data to make it suitable for analysis. This step ensures accurate results and better model performance.

Feature Engineering: Relevant features or variables are extracted from the data that might help distinguish normal behaviors from fraudulent ones. These features could include transaction frequency, location, time of day, purchase amounts, and more.

Anomaly Detection: Data Science techniques, such as statistical analysis and machine learning algorithms, are used to detect anomalies or deviations from the expected patterns. Unusual behaviors or transactions that don't follow the typical usage patterns can indicate potential fraud.

Machine Learning Models: Supervised and unsupervised machine learning models are trained using historical data to learn patterns of fraudulent and non-fraudulent activities. These models can then predict the likelihood of a new transaction or behavior being fraudulent. Common algorithms include decision trees, random forests, support vector machines, and neural networks.

Ensemble Methods: Combining multiple models (ensemble methods) enhances accuracy and reduces false positives. Techniques like bagging, boosting, and stacking can be employed to improve overall performance.

Continuous Learning: Fraudsters continually evolve their techniques, so models must adapt. Data Science enables the development of models that can learn from new data over time, staying up-to-date with emerging fraud patterns.

Real-time Analysis: In industries where real-time decision-making is crucial (e.g., finance), Data Science helps process and analyze data quickly, allowing for rapid identification of suspicious activities and immediate response.

Behavioral Analysis: Data Science techniques can analyze user behavior patterns to create user profiles. Any deviation from these profiles can trigger alerts for further investigation.

Network Analysis: In cases of organized fraud, such as financial crimes involving multiple parties, network analysis helps uncover connections and relationships between individuals or entities.

Risk Assessment: Data Science assists in assessing the risk associated with different transactions or customers. By assigning risk scores based on various factors, organizations can decide whether to approve, decline, or further investigate certain activities.

Fraud Prevention Strategies: Data-driven insights enable organizations to develop effective fraud prevention strategies. These strategies might include adaptive authentication, two-factor authentication, and transaction monitoring.

Regulatory Compliance: Many industries have regulatory requirements related to fraud prevention and risk management. Data Science helps organizations stay compliant by providing the necessary tools to identify and report suspicious activities.

Feedback Loop: By continuously analyzing outcomes and updating models, organizations create a feedback loop that improves the accuracy of fraud detection over time.

Key areas where Data Science is used for Fraud Detection:

Data Science is extensively employed in various key areas for fraud detection across industries. Some of these key areas include:

Anomaly Detection: Data Science techniques are used to identify anomalies or deviations from normal patterns in large datasets. Unusual behaviors or transactions that don't conform to typical patterns can indicate potential fraud.

Pattern Recognition: Data Science helps recognize patterns of fraudulent activities by analyzing historical data. This can involve identifying common characteristics, sequences, or relationships associated with fraudulent transactions.

Machine Learning Models: Supervised and unsupervised machine learning models are trained on historical data to learn patterns of fraudulent and non-fraudulent behaviors. These models can then classify new transactions or activities as potentially fraudulent or legitimate.

Feature Engineering: Relevant features are extracted from data to enhance the performance of fraud detection models. These features might include transaction frequency, location, time, amounts, and more.

Predictive Analytics: Data Science enables organizations to predict potential fraudulent activities based on historical trends and patterns. Predictive models help in proactive fraud prevention.

Behavioral Analysis: By analyzing user behavior patterns, Data Science can create profiles of normal user behavior. Any deviation from these profiles can trigger alerts for further investigation.

Network Analysis: For complex fraud schemes involving multiple entities, network analysis helps uncover connections and relationships between individuals or entities.

Real-time Monitoring: Data Science enables real-time monitoring of transactions and activities, allowing organizations to promptly detect and respond to fraudulent actions. Data Science enables real-time monitoring of transactions and activities, allowing organizations to promptly detect and respond to fraudulent actions.

Text and Sentiment Analysis: In industries like insurance and finance, analyzing text data (e.g., claims descriptions or transaction notes) can provide insights into potentially fraudulent claims or activities.

Ensemble Methods: Combining multiple models using ensemble techniques improves the accuracy of fraud detection systems and reduces false positives.

Big Data Handling: Data Science technologies allow organizations to handle and process large volumes of data efficiently, which is essential for fraud detection considering the vast amount of transaction data generated.

Continuous Learning: Fraudsters adapt and evolve their tactics. Data Science models can continually learn from new data, staying up-to-date with emerging fraud patterns.

Risk Scoring: Data Science helps assign risk scores to transactions or customers, aiding in decision-making regarding approval, denial, or further investigation.

Regulatory Compliance: Many industries have regulatory requirements for fraud prevention. Data Science assists in meeting these obligations by identifying and addressing suspicious activities.

Visualizations: Data visualization tools aid in understanding complex patterns and trends, helping investigators and analysts make informed decisions.

Collaborative Filtering: In online marketplaces or recommendation systems, collaborative filtering can be used to detect fraudulent reviews or fake profiles.

FAQ's

Feature engineering involves selecting, transforming, and creating relevant features from raw data that enhance the performance of fraud detection models. These features provide valuable information for distinguishing between normal and fraudulent activities.

Data science models can adapt to evolving fraud tactics through continuous learning. They can be updated with new data and insights, enabling them to stay up-to-date with emerging fraud patterns and techniques employed by fraudsters.

Risk scoring involves assigning scores to transactions or customers based on their level of risk for potential fraud. Data science algorithms analyze various factors to determine the likelihood of a transaction being fraudulent, helping organizations make informed decisions.

Data visualization tools help analysts and investigators comprehend complex patterns and trends in data. Visualizations make it easier to identify outliers, anomalies, and suspicious activities, contributing to more effective fraud detection and investigation processes.

Leave a comment

Your email address will not be published. Required fields are marked with *